Know the Difference: Defined Benefit and Defined Contribution

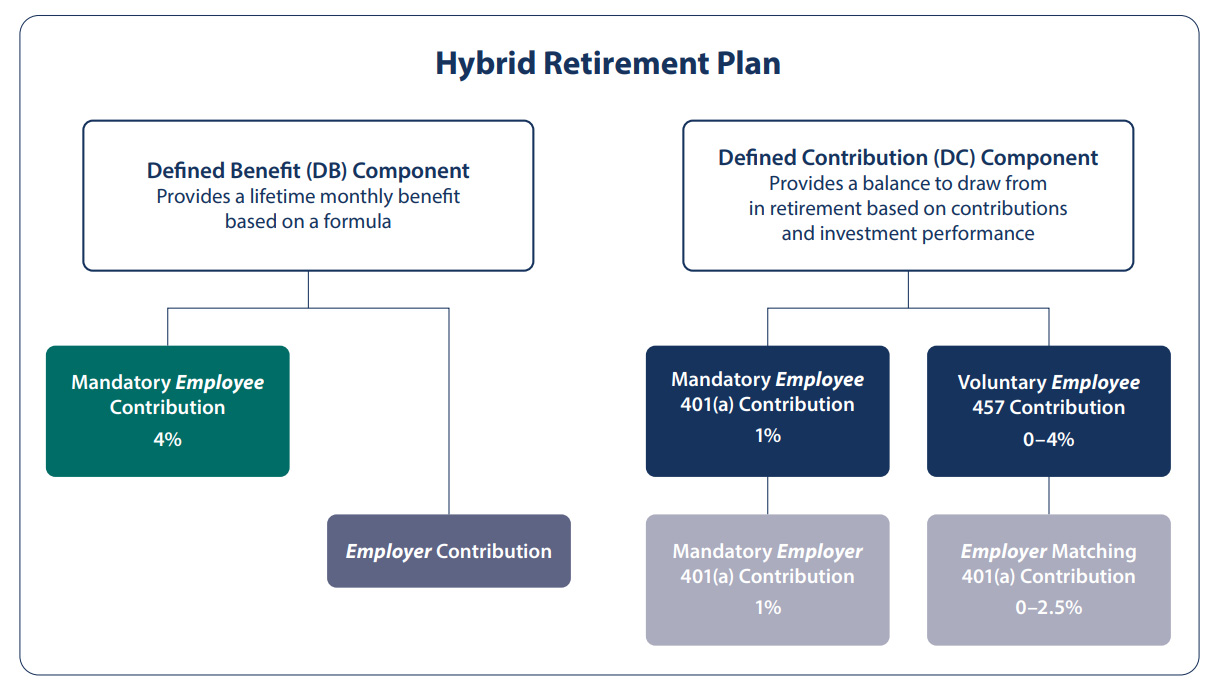

If you’re a Hybrid Retirement Plan member, keep in mind that there are two distinct components to your plan:

- Defined benefit (pension): Provides a monthly retirement benefit based on your age, total service credit and average final compensation. VRS manages the investments and related risks.

- Defined contribution: Provides a benefit based on your contributions, your employer’s contributions and investment performance, like an individual retirement account. You choose from a carefully selected menu of funds and manage them.

Here’s a visual of the hybrid plan structure:

Both you and your employer make mandatory contributions to each component of your plan while you work. You may also contribute up to an additional 4% in voluntary contributions to the defined contribution component. Your employer will match a portion of your voluntary contribution up to an additional 2.5%. Contributing more money over the course of your career can grow your savings compared to what you would earn through mandatory contributions only.

Manage Each Component With Ease

You have two online accounts:

- myVRS (your defined benefit account): View your retirement eligibility date, check account balances, and quickly access information on your life insurance and health insurance credit in retirement, as applicable. Try the benefit estimator and retirement planner to explore your future options.

- Account Access (your VRS defined contribution account): See account balance details, easily adjust your contributions and manage investment selections.

Remember to keep your contact information current in both accounts, which ensures that VRS can reach you and that only you have access to your accounts. Keeping your beneficiary information current in each account will ensure your wishes are carried out in the event of your death. Check to see if your designations are up to date, especially if you experience major life changes such as marriage, divorce or the loss of a loved one.

Know How Your Benefit Is Paid

When you retire, you’ll receive a lifetime monthly retirement benefit from your defined benefit plan. You will choose from four benefit payout options.

For the defined contribution component, you can choose from a variety of distribution options. Learn more on the Getting Ready to Retire page of the hybrid plan website.

See other plan details in the Hybrid Retirement Plan handbookand on the VRS website.