Your VRS Pension Unpacked

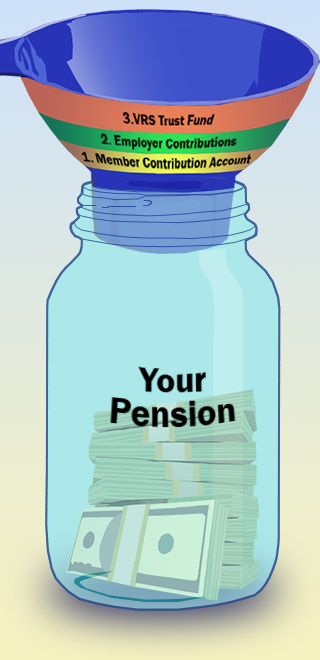

We’re often asked how the VRS defined benefit pension is funded and calculated when you retire. It’s easy to understand when you break it down by its three main components: contributions from you, contributions from your employer and investment earnings from the VRS Trust Fund.

How is your pension funded?

These three funding sources funnel into your defined benefit* monthly payment in retirement:

1. Member Contribution Account

- While you are working, you contribute a percentage of your compensation each month to your defined benefit plan (5% for Plan 1 and Plan 2; 4% for hybrid plan).

- Your account earns 4% interest annually.

- You will see the member contribution amount when you log in to myVRS.

2. Employer Contributions

- Your employer submits a monthly contribution to fund your future retirement benefit.

3. VRS Trust Fund

- VRS invests contributions from you and your employer.

- Approximately two-thirds of retiree benefit payments come from investment earnings.

If you work at least five years (to become vested) in a VRS-covered position and don’t take a refund, you are eligible to receive a monthly benefit when you retire. If you leave employment and take a refund, your VRS membership ends and you will not be eligible for any future VRS benefits.

*Hybrid Retirement Plan members also have a defined contribution component as part of your plan in addition to your defined benefit pension. (Watch a short video to learn how the two components work together.)

How is your pension calculated?

Your monthly benefit is calculated based on a formula:

| Average final compensation Based on your highest consecutive earnings as a covered employee: 36 months for Plan 1; 60 months for Plan 2 and hybrid plan. |

| x Retirement multiplier, as determined by your plan. |

| x Years of service credit |

| = Your annual benefit amount |

| Calculation is based on an unreduced basic benefit amount. Reductions will apply to members who retire early or choose a different benefit payout option. |

Your member contribution account balance is not used to calculate your defined benefit plan retirement benefit. After you retire, your pension is first paid from your member contribution account, where your defined benefit contributions accumulate throughout your career. When your member contribution account is exhausted, your pension is paid from the VRS Trust Fund.

Log in to your myVRS account to take advantage of the Retirement Planner and Benefit Estimator and to view your Member Benefit Profile, which is your annual benefits statement.