Hybrid Plan Members: Pay Yourself First

Let’s be real – saving for the future is probably not the first thing that comes to mind when you get a raise. It’s easy to underestimate the importance of saving early, especially when there are so many exciting or pressing things you could spend that money on today.

But just for a moment, try putting yourself in your own shoes about 30 years from now. What do you hope that version of you looks like? Are you financially stable? Comfortable? Choosing to save early in your career can help you build the future you imagine, and it may make only a slight difference in your spending habits today.

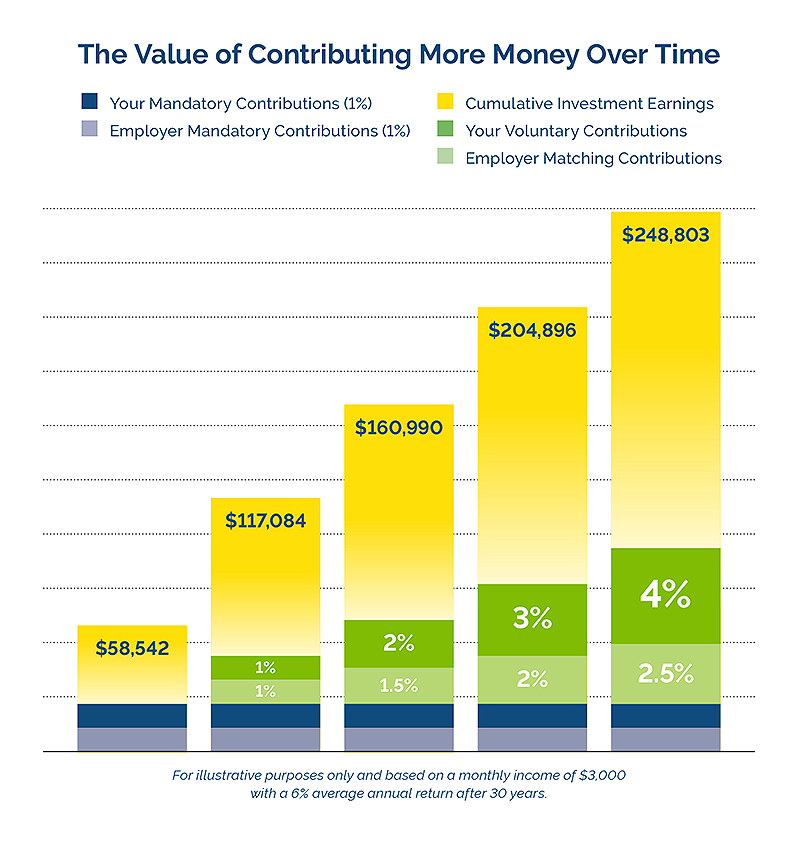

If you received a salary bump this year, put those extra earnings toward your future and set yourself up for a more comfortable tomorrow. Consider increasing your hybrid plan voluntary contributions through Account Access. The more you contribute, the more you will receive in employer matching contributions, up to a 2.5% match when you contribute the maximum 4%. Don’t leave those employer matching dollars on the table.

Hybrid plan members can make changes to their voluntary contributions each quarter (January, April, July, October). You can make changes until 4 p.m. ET on the 15th of the month before the next quarter. Don’t miss this opportunity to increase your contribution before the next deadline on Sept. 15 at 4 p.m. Your future self will thank you!

More Savings Tips

Project how saving will affect your take-home pay using the paycheck calculator.

If slow and steady is more your style, consider using SmartStep to set annual automatic increases to your Hybrid Retirement Plan voluntary contributions until you reach the maximum of 4%. Log in to Account Access, select your Hybrid Plan account, then click on Contributions to enter an amount for SmartStep.

Pro Tip: Log in to your myVRS account to take advantage of other useful tools, including the Retirement Planner, Benefit Estimator and myVRS Financial Wellness, where you’ll find interactive courses, personalized action plans and content based on your interests.