Board Certifies FY 2025-2026 Rates for Statewide Plans and OPEBs

Every year, VRS and the plan actuary review trends in the member population, including hiring, retirements, salaries and other changes. These trends influence the overall funded status of pension and other post-employment benefit plans, and in odd-years actuarial valuations determine employer contribution rates for the next two years.

At its October meeting, the VRS Board of Trustees voted to certify FY 2025-2026 defined benefit contribution rates for the five statewide retirement plans.

| Retirement Program | Board-Certified FY 2025-2026 Defined Benefit Rate* |

|---|---|

| State Employees | 12.52% |

| Teachers | 14.21% |

| State Police Officers’ Retirement System (SPORS) | 31.32% |

| Virginia Law Officers’ Retirement System (VaLORS) | 22.81% |

| Judicial Retirement System (JRS) | 30.66% |

* Employers with Hybrid Retirement Plan members will also need to make matching defined contribution hybrid plan contributions of 1.0%-3.5% based on member elections. For fiscal year 2023 this equated to 1.34% of total payroll for the state retirement plan, 2.23% for JRS and 1.02% for the teacher plan. These percentages will vary going forward as the hybrid plan population grows.

The board also certified rates for other post-employment benefits (OPEBs) -- group life insurance, the health insurance credit (for eligible state employees and teachers) and the Virginia Sickness and Disability Program (VSDP).

Pending state budget approval, the certified employer contribution rates for the defined benefit retirement plans and associated OPEBs will go into effect July 1, 2024.

State law (§ 51.1-145) requires VRS to set employer contribution rates “in a manner so as to remain relatively level from year to year.” At the same time, VRS must ensure future contributions and current plan assets still are on track to provide for all benefits promised to members and beneficiaries.

Important Reminder About Hybrid Rate Separation

Beginning July 1, 2024, the board-certified employer contribution rates for the retirement plans will apply only to the defined benefit portion of the benefits. Previously, the board-certified employer rates included an estimate of the defined contributions for Hybrid Retirement Plan members. Next year, employers will pay the defined benefit contribution rate and continue to fund mandatory and matching contributions to the defined contribution component of the hybrid plan. The defined contribution amount will vary based on each member’s voluntary contributions election. See hybrid rate separation.

A Closer Look at the Statewide Plans

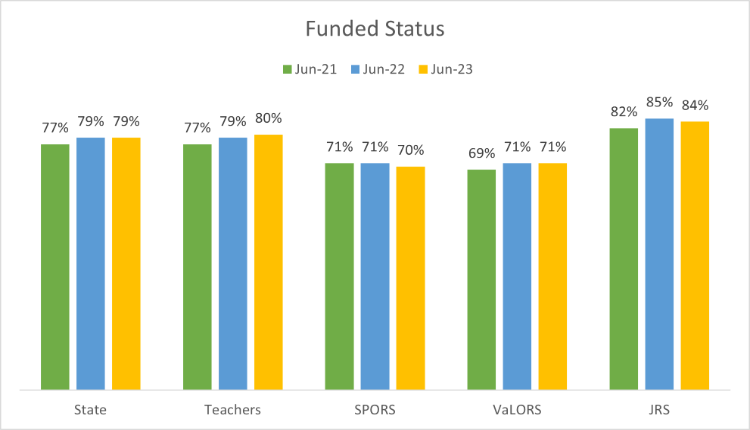

Overall, the funded status of the five statewide retirement plans remained stable, based on the June 30, 2023, valuation conducted by Gabriel, Roeder, Smith & Company (GRS), the VRS plan actuary.

The number of employees in the state retirement plan and VaLORS increased from the previous year, while headcounts trended slightly lower for the teacher plan, SPORS and JRS.

All plans saw increases in average salary from 2022 to 2023, owing to series of pay increases approved by the General Assembly. Due to persistent inflation, retirees received near-maximum or maximum cost-of-living adjustments in 2022 and 2023.

The FY 2025-2026 contribution rates for the state and teacher retirement plans and VaLORS are lower than those paid for FY 2023-2024. Meanwhile, rates for SPORS and JRS will increase slightly.

Investment gains from recent years (namely the 27.5% return in 2021) will continue to be spread over the next few years, which helps keep expected contribution rates steady. Also, cash infusions to the trust fund made by the General Assembly in recent years helped reduce the unfunded liabilities for the plans.

While the funded status and contribution rates are stable, plan unfunded liabilities remain. The VRS board approved a funding policy change to reset the total unfunded accrued liability to be amortized over 20 years. This means a slight increase in contribution rates in the short term; however, the action results in getting money into the fund more quickly to be invested sooner, leveling out the amortization payments in later years and is expected to result in contribution savings of more than $1 billion over a 20-year period.

Contribution rates for group life insurance, the health insurance credit for state employees and teachers and VSDP will decrease in FY 2025-2026.

Political Subdivisions, LODA and VLDP

Later this month, the VRS board will certify contribution rates for:

- All political subdivisions.

- The Virginia Local Disability Program (VLDP).

- The Line of Duty Act (LODA).

Next quarter, VRS will send actuarial reports, including the retirement plan contribution rate, to all political subdivisions, along with rates for the health insurance credit, if applicable.

Employer contribution rates provided for non-professional school board and political subdivision plans, including VLDP and the health insurance credit for political subdivisions, are final once certified by the VRS board at its November meeting.

Next Steps

The governor will present his fiscal year 2025-2026 budget, including a recommendation regarding the funding of the VRS-certified contribution rates for statewide plans and other post-employment benefits.

Final VRS contribution rates will be available at the conclusion of the General Assembly session and passage of the state budget next spring.