Your Turn to Ask

August 2024

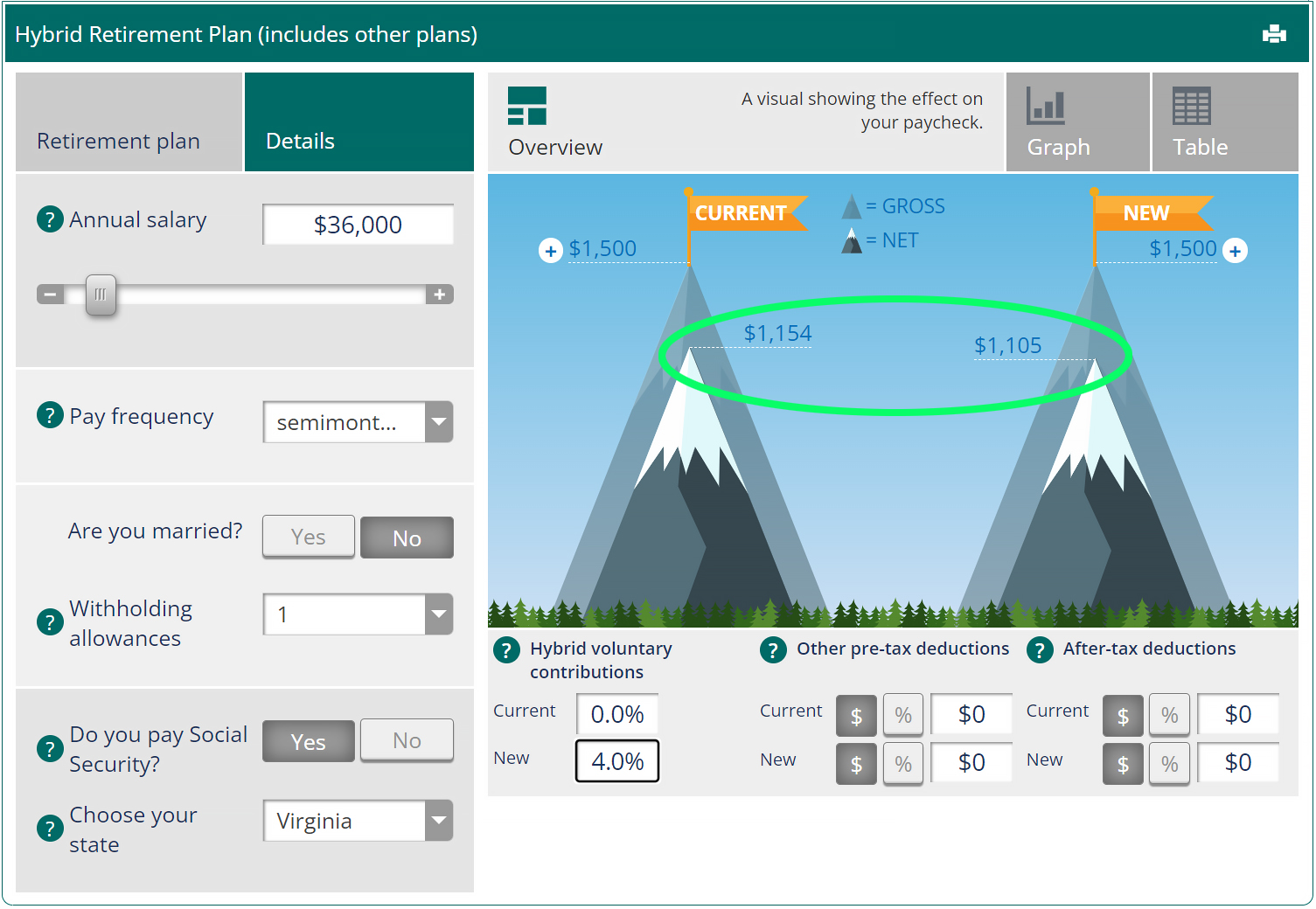

I want to max out my voluntary contributions to the Hybrid Retirement Plan. How can I preview the impact on my take-home pay?

Maximizing your voluntary contributions can significantly boost your retirement savings over time. Plus, you’ll get the maximum employer match. Use the Paycheck Calculator to see how increasing your pretax contribution will affect your take-home pay.

- Enter your information. Key in your salary, pay frequency, current voluntary contribution rates and the total of any other deductions that appear on your paystub, such as the cost of health care coverage and your mandatory contributions.

- Adjust voluntary contributions. Set your new hybrid plan voluntary contribution rate to the maximum 4%.

- Review the results. The impact on your net pay may be less than you think. In the example below, based on an annual salary of $36,000, the difference is less than $50.

If you don’t want to contribute the full 4% right now, consider using SmartStep to make small annual adjustments to your contributions. For details, visit the Hybrid Retirement Plan website.