Quick Counseling Tips for Hybrid Retirement Plan Members

The VRS Hybrid Retirement Plan combines a traditional defined benefit (DB) pension plan and a defined contribution (DC) plan, like a 401(k).

Employees should explore our handy online overview, which quickly explains how the hybrid plan works and points them to in-depth resources about their plan and other retirement benefits.

Cover these quick counseling tips with employees:

1. Two Accounts, Instead of One

Since the hybrid plan has DB and DC components, members will have to set up myVRS and DCP accounts. They will need to name beneficiaries through both accounts. Additionally, they will set voluntary contributions through their DCP account login.

2. Don’t Miss Out on the Match

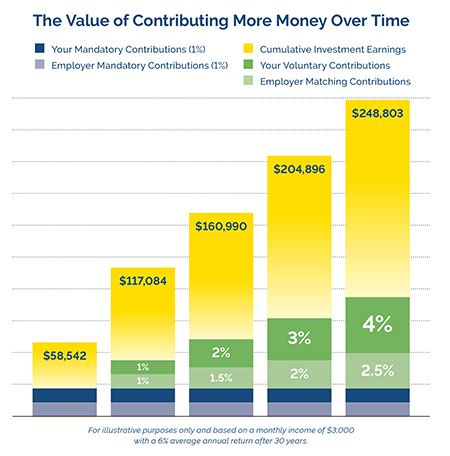

Hybrid plan members who make tax-deferred voluntary contributions to their DC account are eligible for employer-matching contributions. If they contribute the maximum 4%, they will receive the full 2.5% employer match.

The earlier members invest, the more those investment earnings compound over time and the more savings they’ll have for future goals.

3. Learning More About the Plan Is as Easy as Pressing Play

On the Hybrid Learning Channel, members can watch short videos on topics that matter most, such as benefits they’ll receive in retirement and the steps they can take to get ready.